ACH is the name for the network used by BankNewport and other financial institutions to move large volumes of debit and credit transactions in a batch format. And if that happens, you could be charged additional fees or penalties.Automated Clearing House, or ACH, is a Cash Management service we offer businesses. If you’ve set up automatic bill payments using ACH, payments may not go through if there isn’t enough money in your account to cover the payment.

It’s also important to consider how much money is in your account.

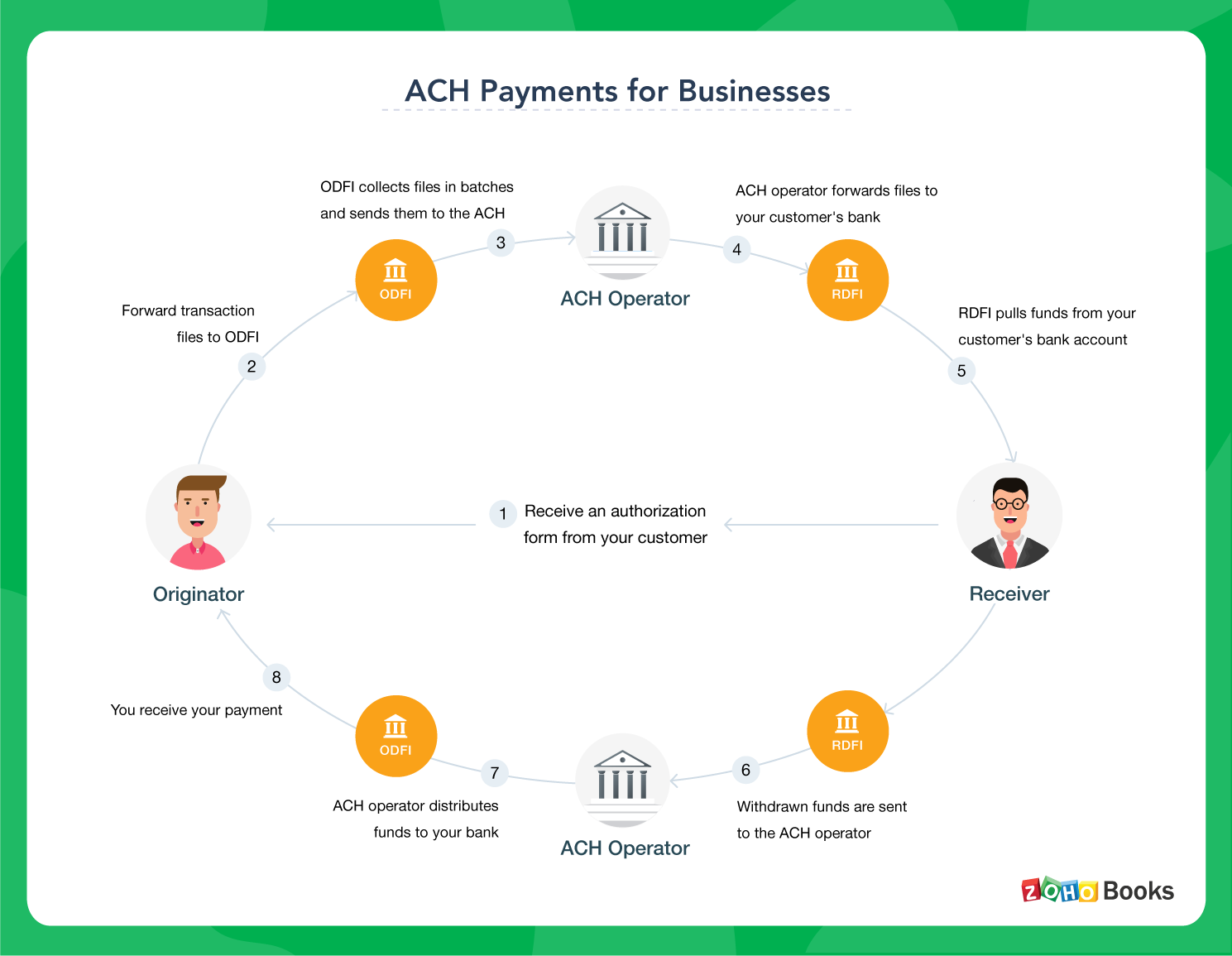

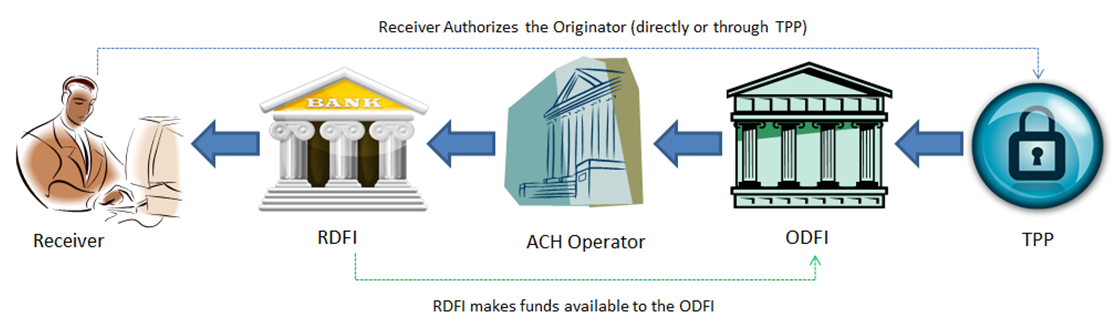

If you’re using your savings account to make ACH transfers, check with your bank about any restrictions. Typically, these kinds of rules apply to savings accounts. Some banks put a limit on how many ACH transfers customers can make each month. If you need to send money to a friend, an ACH transaction through a payment app-such as Zelle®, Venmo or PayPal®-may be less expensive than a traditional wire transfer.īut there are a few things to be aware of. And payment encryption could make ACH payments more secure than writing checks. By automating payments, you can avoid having to put a check in the mail every month. Using ACH payments to get paid and handle bills offers plenty of convenience. Or, if your account has overdraft protection, you may have to pay an overdraft fee if paying the bill caused your account to be overdrawn. Otherwise, you may have to pay a late payment fee if the payment doesn’t go through due to insufficient funds. It can even help you avoid missing bill due dates if your account is already set up to automatically pay your bills on time.īut it’s important to make sure you have enough money in your account to cover the bills. What does that mean for you? Using automatic payments for your recurring bills can be convenient. Using ACH also allows businesses to accept automatic payments. And ACH payments may cost less than wire transfers. EFT PaymentsĪCH payments may be faster and more secure than regular checks because they’re encrypted, meaning the information is hidden using a code. There are a variety of ACH transaction types, but this is one common example of ACH in action. Assuming all requirements are met, like having sufficient funds in your account, the transaction is then processed and delivered. Then each month, the ODFI (the insurance company’s bank) requests a payment from the RDFI (your bank). When you sign the authorization form to sign up for automatic payments, the process begins. Take, for instance, an automatic monthly payment for your car insurance. Receiving depository financial institution (RDFI): The bank or other financial institution that receives the ACH transaction.Originating depository financial institution (ODFI): The bank or other financial institution that initiates the ACH transaction.Is ACH the Same as a Bank Transfer?īefore jumping into how ACH transactions work, here are some basic terms to know: The company billing you initiates an ACH debit at the specified amount at a specified time. While most payment networks can only do one or the other, ACH can either push or pull as needed.ĪCH deposits: If you signed up for your company’s direct deposit program, payday might happen like this: A push payment sends an ACH credit to your account, transferring the money from your employer to you.ĪCH payments: When you make payments to a business, lender or insurance provider, this is a pull ACH transaction. Pull transactions are debit transactions, and the recipient’s bank initiates the transfer and pulls money from the payer’s account. Push payments are credit transactions, where payers instruct their bank to send money from their account to another account. Though they sound similar, they’re a little bit different. Push payments send money, and pull payments collect it. ACH payments are usually divided into push payments and pull payments.

0 kommentar(er)

0 kommentar(er)